Are you a small business owner looking to strengthen your skills in business planning, financial management, record keeping, tax, and superannuation?

The Australian Taxation Office (ATO) is hosting a free, live webinar designed to support small businesses in managing their operations more effectively. Whether you're just starting out or looking to sharpen your knowledge, this session will equip you with practical tools and insights to confidently handle your business finances, including invoicing and tax obligations.

What you will learn

- Find out which employees are eligible and how to calculate, lodge, and pay super correctly to avoid penalties.

- Get practical guidance on business planning, financial management, and record keeping.

What to expect

- Live Q&A with experienced ATO tax advisors

- Tailored insights to support your business journey

- Guidance on your employer obligations

- Explore free courses and resources available for small businesses

Ready to take the next step?

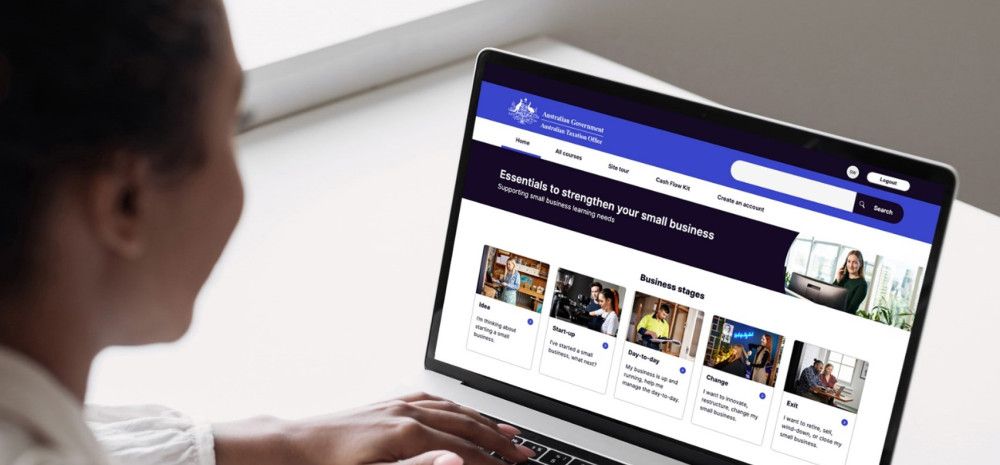

Visit smallbusiness.taxsuperandyou.gov.au for tools, tips, and information designed specifically for small businesses.

If you require additional assistance to participate, please get in contact with us.

Monday 10 October, 12pm-1pm